$311,947 locked in a no-loss lottery

Amazon is successful because it built something that would have been impossible without the internet.

With open blockchains, we have the same question - what are the solutions that would otherwise be impossible without trust minimized technology?

Although for some, it might be hard to see these solutions, there are many. I’ll go through one and compare how this would or wouldn’t work without blockchains.

Mid-2019, a project named PoolTogether was launched - a no loss lottery built on Ethereum.

It works like this:

People pool money together

Everyone receives a ticket

The total money is then given out as overcollateralized loans to earn interest

After one week, loans are paid back, everyone gets their money back, and the winning ticket receives the total interest as a prize.

So, you can’t lose any of your money, but you can win the prize, which is the interest earned by the cash everyone pooled together for one week.

Or you can put it this way - save money, and in return for not spending it, you might win more money.

Right now, players have pooled $311,947 into the lottery, and the winner is receiving around $250 per week as rewards for taking 0 risks (excluding technical risks).

This app wasn’t possible before. Since Ethereum is a fully digital, open-source, permissionless liquidity provider, it removes the friction that would have made an idea such as PoolTogether economically inviable before.

What does it mean to be an “open-source, permissionless liquidity provider”?

Think of it as a digital bank with these characteristics:

It’s fully auditable by anyone (since the code and the assets on it are public)

It’s fully automated by a computer code & smart contracts, eliminating almost any need for human interaction (thus taking the costs down)

Anyone can make their product, and plug into this digital bank, without needing permission.

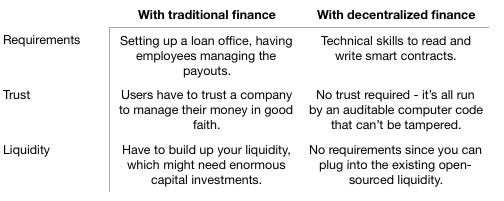

Now, let’s compare the friction PoolTogether would have if they’d decide to build this without blockchain-based networks:

An idea like PoolTogether can’t use the liquidity Goldman Sachs has on their balance sheet. However, with open and permissionless blockchains, PoolTogether can use the liquidity of the digital “banks” built on Web 3.0. Therefore, they can build their apps without friction.

You can read more about PoolTogether here: https://www.pooltogether.com

-Edgar